Extract from The Guardian

Although the amounts

appear insignificant, the cuts in payments to new welfare recipients

will hit hard for the most disadvantaged Australians

Axing the clean energy supplement will in effect

be abolishing the first real increase in Australian unemployment

benefits in 20 years. Photograph: Mick Tsikas/AAP

Contact

author

Saturday

13 August 2016 09.33 AEST

For

many people, $4.40 a week is a small sum – trivial even. A cup of

coffee on the way to work, the parking change in the car console.

But

for those Australians set to lose between $4.40 and $7.05 a week in

one of the 45th parliament’s first legislative acts, many of them

living below the poverty line, those small sums will make the dire

choices of subsistence budgeting even more desperate.

The

cuts will come from the abolition of the clean energy supplement,

which varies according to the benefit: $4.40 a week for single

unemployed, $7.05 a week for a single person on the aged or

disability pension.

It’s

a lethally clever way for the government to save $1.3bn over four

years from 2.2 million of the most disadvantaged Australians, with

less political blowback than other blunter attempts at welfare

savings.

It’s

lethal precisely because it seems like an insignificant amount, and

because the cuts apply only to new welfare recipients, so no one

actually loses anything they are now getting.

And,

so the argument goes, the supplement was supposed to compensate for

the carbon tax, and that got repealed, so the clean energy supplement

has become an unnecessary and unjustifiable windfall. Something they

don’t really need or deserve.

Perhaps

that’s why it’s caused barely a ripple.

Except

none of those arguments are true, and none can justify this cut to

benefits, which both major political parties, and even the Business

Council of Australia, have conceded for many years are way too low.

For

those people affected, the amounts are not at all insignificant. For

Rob, a disability support pensioner living in country Victoria and

looking for work, losing $7 a week would mean cutting back further on

heating, or possibly food.

“At

the moment I only heat the lounge room and I set it to 18 degrees

because I can’t afford the bills if I turn it up higher,” he

says. “I budget about $5 a day for my main meals, so I might have

to cut that back, or I might rethink whether I visited a friend

because I might not be able to afford the petrol money.”

Single

parents are already struggling to pay for books or school trips.

And

the impact will spread quickly. An unemployed person who takes a job

and then loses it and reapplies for Newstart will no longer be

eligible for the benefit. The government’s savings are based on

estimates that within four years it will not be paying the supplement

to 2.2 million people who would otherwise get it.

And,

for welfare recipients, it really isn’t a windfall at all. In fact

because of the way the supplement was introduced, if it’s cut they

will be worse off than they would have been if the carbon tax had

never happened. This is because the carbon tax adjustment also took

into account a regular inflation adjustment that would have happened

anyway. So, as

explained in this blogpost, axing the clean energy supplement

doesn’t take away a windfall; it actually leaves a single person on

Newstart $1.80 worse off than they would have been if there had never

been a carbon tax. The whole rationale for the “saving” is false.

And

as well as ushering in a two-tier welfare system, with higher

payments for existing recipients, and lower ones for those getting

benefits after the supplement is cut, there also seems to be a double

standard for what counts as a windfall.

The

carbon tax adjustment payment for welfare recipients is incorrectly

labelled as a windfall that must be removed, but everyone else’s

compensation came in the form of a tax cut, a real windfall, which

they got to keep. So the unemployed person loses $4.40 a week and

ends up behind, but the person earning $60,000 keeps a tax cut worth

about $10 a week and stays ahead.

The

reality of what is being proposed here is even more shocking when you

consider the recent history of Newstart in Australia.

Axing

the clean energy supplement will in effect be abolishing the first

real increase in unemployment benefits in 20 years. The last increase

was in 1994, when it rose by $2.95 a week. Research by the Australia

Institute shows that the cuts will put a family living on

unemployment benefits on a historic 32% below the Henderson poverty

line, exacerbating the steady erosion in the value of their payments.

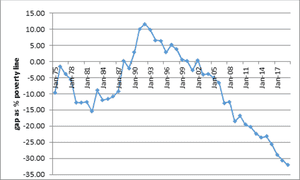

The

graph shows the difference between the Henderson poverty line and the

amount of government assistance going to an unemployed family of four

– two adults and two children. The data beyond 2015 are TAI

projections based on the CPI forecasts in the Budget Papers (which is

used to index unemployment benefits) the assumption that the poverty

line will follow recent trends (at the average increase over the last

20 years). The graph also assumes the government implements its

policy of removing the carbon tax compensation.The Australian Council

of Social Service says the cuts are unconscionable and contradict

repeated agreements from governments, business and unions that

unemployment benefits should rise.A poll by the Australia Institute

in Tasmania shows 60% of voters do not support the cut. But in the

dying days of the election campaign, despite committing to review the

adequacy of unemployment payments, Labor included the savings from

cutting the clean energy supplement in its own budget calculations,

giving the Turnbull government a powerful case to argue that the ALP

should now back the legislation.So the 45th parliament will begin

with legislation to reduce tax for people earning more than $80,000,

and $48b in tax cuts for companies, and also $1.3m in “savings”

from mean incremental cuts to the meagre payments to the most

disadvantaged Australians, many of whom are already living in

poverty. Is that really how it wants to start? And should those of us

for whom $4.40 is loose change allow that to happen?

No comments:

Post a Comment