Australia Institute modelling shows top 20% of taxpayers get 80% of benefit of final two stages

The final stages of the Turnbull government’s plan to dramatically flatten Australia’s income tax scales will provide a multibillion-dollar boon to the top 20% of income earners, and they deserve further scrutiny by parliament, a progressive thinktank says.

The Australia Institute has produced new modelling of the most expensive elements of the government’s income tax plan, saying the Senate needs to understand how skewed they are towards richer households.

The plan – announced in the budget – is designed to be rolled out over the next seven years, in three stages.

The first stage of the plan, which is directed towards low and middle income earners, appears to have enough support to pass the Senate.

It will provide a new tax offset, worth up to $530, for people earning between $48,000 and $90,000.

But the second and third stages of the government’s plan, which are directed towards high income earners, have been questioned – but not rejected – by the Labor party and other crossbenchers.

Part of stage two, and all of stage three, will increase the 32.5-cent-in-the-dollar income tax threshold from $90,000 to $200,000 and eventually abolish the 37-cent tax bracket from mid-2024, flattening the income tax scales.

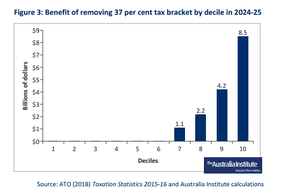

The Australia Institute has modelled the distributional impacts of those elements of the tax plan to show how heavily skewed they are towards richer taxpayers.

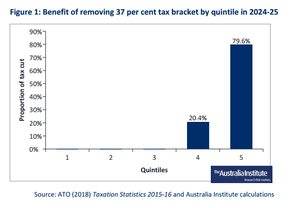

The modelling shows the top 20% of taxpayers will receive 80% of the benefit of the final two stages of the plan, while the next 20% will receive the remainder of the benefit. It shows 60% of taxpayers will receive no benefit.

The top 20% of taxpayers will have a tax cut of $12.7bn, while the next 20% will get the remaining tax cuts, worth $3.3bn.

“The parts of the government’s income tax plan that are at risk of not passing the Senate are the parts that will overwhelmingly go to high income earners,” said Matt Grudnoff from the Australia Institute.

“The government’s tax plan will flatten income tax and make it less progressive ... these tax cuts will also reduce the government’s ability to raise revenue in the future, which will prove unsustainable if the economy slows and government revenues fall.”

Labor leader Bill Shorten announced his alternative income tax policy in his budget reply speech two weeks ago.

He pledged to “go further and do better” for low and middle-income Australians, supporting the government’s first phase of income tax cuts, but then almost doubling the tax relief from 2019-20 for up to 10 million workers.

The Australian National University’s centre for social research and methods says the Coalition and Labor’s duelling income tax plans will both lead to a less progressive tax system because they don’t sufficiently address bracket creep, which disproportionately affects low and middle-income households.

But it says the Coalition’s plan will erode the tax system’s progressivity a little more than Labor’s, because it will leave the top 20% of households paying a noticeably smaller proportion of personal income taxation by 2027-28.

Labor says it has not decided if it will support the second and third stages of the government’s income tax plan because it wants to submit them to parliamentary scrutiny.

It plans to raise questions with Treasury officials on Tuesday and Wednesday, during Senate estimates hearings.

No comments:

Post a Comment