Extract from The Guardian

Nielsen study commissioned by Acma says most gambling ads shown on free-to-air were from online bookmakers.

Wed 18 Oct 2023 01.00 AEDT

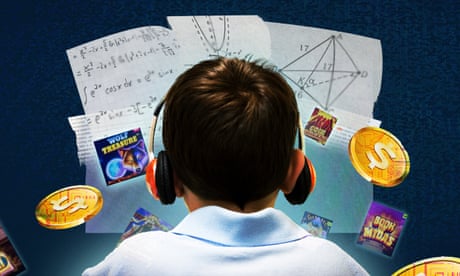

Last modified on Wed 18 Oct 2023 07.22 AEDTThe findings came as the federal government considered whether to accept a bipartisan parliamentary committee’s recommendation to ban all gambling advertising from online bookmakers within three years, based on “powerful evidence” of community harm.

The Australian Communications and Media Authority (Acma) commissioned the audience analytics company Nielsen to survey all gambling advertisements on radio, television and online platforms between May 2022 and April 2023.

The Nielsen study did not review gambling ads that aired on pay TV or subscription streaming services, which means the total number of wagering ads during the 12-month period was higher than 1m.

Nielsen found the clear majority of gambling ads were from online wagering companies, which dominated spending on television, radio and online in an increasingly competitive market.

It found five online wagering companies were responsible for “almost half a million gambling ads aired in the 12 months”. Acma did not name the companies.

According to Nielsen, there were on average 1,381 gambling spots every day on free-to-air television in capital cities. The average was slightly lower in regional TV markets, at an average of 928 a day.

The highest concentration of gambling ads on free-to-air TV was between 9pm and 10pm, when restrictions on broadcast advertising eased. Almost a quarter of all gambling ads aired between 7pm and 10pm.

“For metro radio, more gambling advertising spots aired during morning and evening commuting times,” the Nielsen report said. “Between 6am and 8am, 27,200 ads aired, and between 5pm to 6pm there were 16,300.”

Roughly 66% of all gambling ads on radio and television aired in metro markets, reflecting higher audience numbers in capital cities.

The report found gambling companies spent $162m on free-to-air-television, $34.6m on social media advertising, $22.4m on metro radio markets and $19.5m on other online platforms.

Earlier this year, the peak body for free-to-air commercial broadcasters strongly rejected calls for further restrictions on gambling advertisements, warning free coverage of sport may be cut as a result.

Free TV Australia argued the extent of wagering advertisements on television had been grossly exaggerated by some anti-gambling advocates.

After the committee’s recommendation to ban online wagering ads within three years, the group’s chief executive, Bridget Fair, said the “kneejerk” decision would “ultimately hurt viewers and the television services they love”.

“Measures like frequency caps would be a better and more targeted approach to respond to any community concern around volume of advertising,” she said.

Australia’s biggest online wagering company, Sportsbet, increased its marketing spend by $19m in the first half of 2023 compared with the same period a year earlier. The Nielsen study captures a part of that spend.

Tim Costello, the chief advocate of the Alliance for Gambling Reform, said Sportsbet was spending big on ads while it could to generate profits before the expected ban on ads.

Sportsbet said its marketing spend was “seasonal and dependent on a range of activities”. “This supports racing and sporting industries,” a spokesperson said.

The ministers responsible for gambling advertising have been extensively lobbied by gambling companies, their peak body Responsible Wagering Australia, and harm reduction advocates ahead of their response to the parliamentary committee’s recommendations.

No comments:

Post a Comment