Extract from The Guardian

Australia’s building boom comes amid $485.8bn in pipeline construction activity globally.

Last modified on Wed 23 Feb 2022 16.12 AEDT

Australia is spending billions to build thousands of kilometres of new gas pipelines that may end up worthless stranded assets as the world moves to deal with climate change.

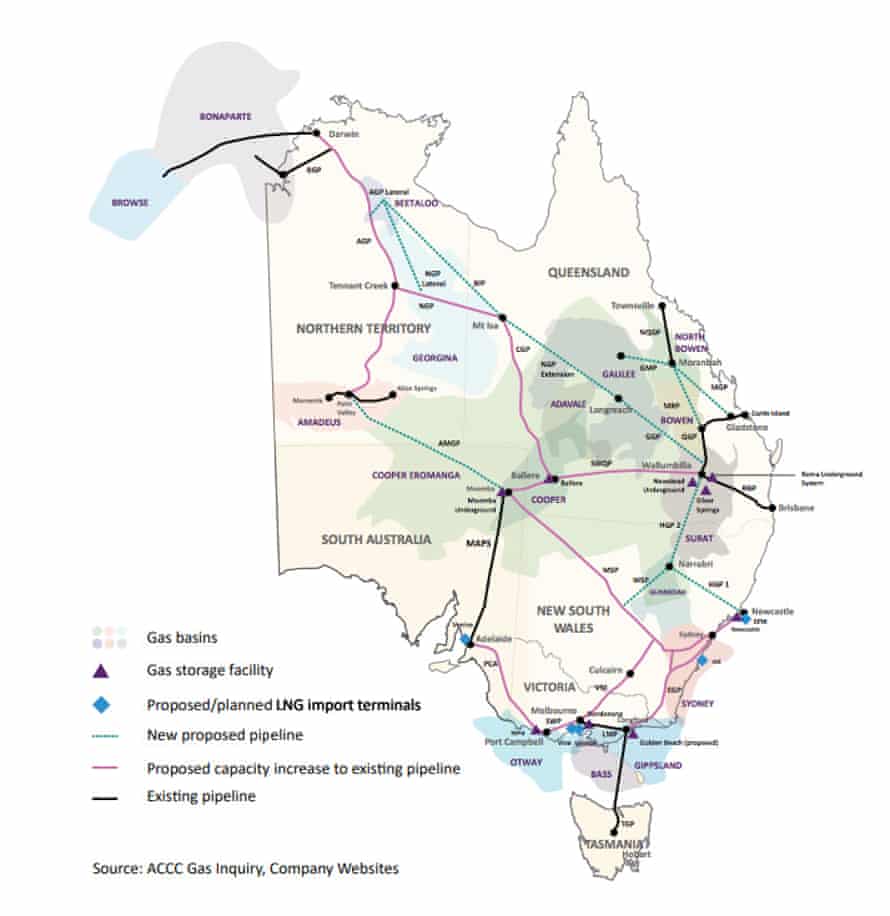

The warning comes in a new report by Global Energy Monitor tracking 600km of pipelines currently under construction and 12,200km of proposed new infrastructure across Australia, with the total value of this work amounting to $25.8bn (USD$18.6bn).

According to the report, these projects include “substantial capacity expansions planned along the existing national network”, which “highlights the Australian government’s unbridled enthusiasm” for the gas industry despite the risk of creating stranded assets.

Should they all go ahead, these pipelines would lock in decades of new production in several basins on the east coast including Beetaloo and Narrabri, and the Scarborough gas field in the north-west, by connecting them to export terminals.

While the projects tracked in the report are consistent with what appears in the 2021 National Gas Plan, it also includes the west-east pipeline proposed by former Dow Chemical Global chairman Andrew Liveris.

The proposal – first suggested in the mid-1970s – has long been considered unviable for a range of reasons and the most recent iteration has faced opposition even from within the fossil fuel sector.

Australia’s building boom comes amid $485.8bn in pipeline construction activity globally – made up of 408 new pipelines, 70,900km of which are currently under construction and an additional 122,500km planned – despite a global push to divest from new fossil fuel investment.

“The world is at an inflection point, where it can hasten the transition to renewables or further entrench itself in fossil fuels,” the report says. “It is choosing the latter.”

The burning of fossil fuels such as gas is a key driver of global heating. Last year the International Energy Agency said limiting global heating to 1.5C, a goal set out in the Paris agreement, meant exploration and exploitation of new fossil fuel basins had to stop in 2021.

Dan Gocher, Australasian Centre for Corporate Responsibility’s director of climate and the environment, said the scale of construction in Australia showed the “toxic level of influence” fossil fuel companies had on government.

“We don’t need the gas,” Gocher said. “Gas demand on the east coast is forecast to flatline or decline. And once state governments get serious about addressing domestic gas demand that demand will really start to decrease.

“It’s a massive stranded asset risk either for the taxpayers that build them or the companies that operate them.”

Tim Buckley, energy transition analyst and director of Clean Energy Finance, said despite “platitudes to decarbonisation” companies were not taking divestment risk seriously.

But he said that would change over the next few years as governments and regulatory authorities begin to crack down on “greenwash” and large investors grow serious about pulling their money out of fossil fuel production.

“You can’t keep investing half a trillion bucks in gas pipelines and think that in any way that aligns with the Paris targets,” Buckley said.

“When you build a gas pipeline you build it for 50 years, we’ve got a climate emergency which we need to act on in eight years. How can you build an asset like that when you have to change by 2050?”

Global Energy Monitor is a San Francisco-based energy monitor that tracks new fossil fuel developments and advocates for a transition to clean energy. It also publishes the Global Coal Plant Tracker, which follows investment in new coal power plants worldwide.

No comments:

Post a Comment