Extract from The Guardian

Letters to old addresses, wildly wrong earnings figures, duplicated employers and inaccurate averaged yearly incomeCentrelink orders frontline staff in branches not to process disputes over flawed debt recovery scheme and instead refer people to online portal. Photograph: Tracey Nearmy/AAP

Christopher Knaus

Friday 13 January 2017 06.15 AEDT

Internal records show how Centrelink’s flawed debt recovery system is sending letters to old addresses, getting earnings figures wildly wrong, duplicating employers and inaccurately averaging out yearly income.

Guardian Australia has obtained a series of staff logs relating to a $14,000 welfare debt imposed on a nurse, who asked for anonymity, late last year.

The woman says the entire debt is false, but, despite lodging a dispute, has been referred to a debt collector and forced to start paying $140 a week.

The staff logs document the attempts of Centrelink to review the $14,000 debt created by the automated system, and further highlight the dangers of removing human oversight.

The widespread examples of flaws in the system come as the ABC reveals an internal Centrelink memo ordering frontline staff working in branches not to process disputes over the flawed debt recovery scheme and instead refer people to an online portal.

The memo says staff “should refer customers online to undertake the intervention” and “must not process activities in relation to the Online Compliance Intervention”.

Centrelink’s initial letter to the nurse was sent to an old address in August, and she remained oblivious to any potential debt.

Because she failed to reply, the information held by the Australian taxation office was taken to be accurate and Centrelink created three separate debts in early October for supposedly overpaid youth allowance, worth $3,700, $4,300, and $6,560.

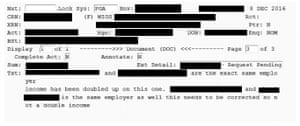

But staff logs show the automated system had repeatedly duplicated employers, failing to identify instances where a business had been named in two different ways.

Staff logs show Centrelink’s automated system is erroneously duplicating employers. Photograph: -

Centrelink staff, when they reviewed the case in November, quickly discovered the problem. “[Name removed] and [name removed] are the exact same employer income has been doubled up on this one,” staff logs noted.

And again: “[Name removed] and [name removed] is the same employer as well this needs to be corrected so not a double income.”

And again: “Customer has declared earnings under [name removed] for match data period. ABN search shows both ABN’s relate [name removed]/[name removed], have made the decision to upload match data to current employer on system and update ABN.”

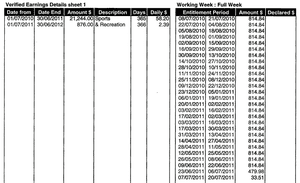

Because she had not responded to initial letters, the system also crudely averaged out the yearly income for the 12 different employers she had worked for on a part-time or casual basis between 2010 and 2014.

A screenshot showing how Centrelink’s automated system is crudely averaging out an annual income over fortnightly reporting periods. Photograph: -

Her yearly income for each of those employers was spread out across Centrelink’s 26 fortnightly reporting periods, making her ineligible for youth allowance and creating debts.

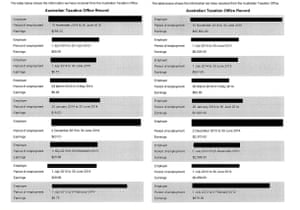

The initial letters, even had they gone to the correct address, contained glaring errors. A first letter, sent on 4 August, tells the woman that Australian taxation office records suggest she earned a total of $956 from 17 employers between 2010 and 2014. A second letter, sent a week later, changed that figure to $95,613.

Centrelink sent these two letters to the same woman within a week of each other – the first showing glaring errors. Photograph: -

The error was later noted by staff in the logs in mid-September. “The income details recorded in the initial PAYG contact letter may differ from the amounts advised by the ATO. The customer has been issued with a second PAYG contact letter with the correct details on it,” staff noted.

“Customer has been advised by phone that a new contact letter will be issued. After speaking to cust [sic] appears we have an old address, so have now updated the current address.”

But, even when staff realised they had sent the initial letters to the wrong address, another mistake was made.

Staff took down the woman’s newer address inaccurately, and the three subsequent debt notices were sent to someoneelse’s address. The failure to respond to those letters saw the woman referred to the debt collection agency, Dun & Bradstreet.

She was forced to begin paying the debt, even though she has lodged a dispute. The woman placed $500 on a credit card to afford the repayments. She said she has also suffered considerable distress.

The nurse has given Centrelink all of her payslips showing that she had properly reported her income and was eligible for benefits.

No comments:

Post a Comment