Extract from The Guardian

Only the controversial Carmichael mine has opened, while a dozen other projects are shelved, lapsed or discontinued.

Last modified on Sun 9 Jan 2022 06.02 AEDT

Queensland’s huge untapped Galilee coal basin was touted as a jobs and revenue bonanza by its supporters, with the potential to liberate hundreds of millions of tonnes of harmful greenhouse gases.

The Galilee’s potential as a “carbon bomb” was wrapped up in a dozen or more coalmining projects and estimates of billions of dollars of investment.

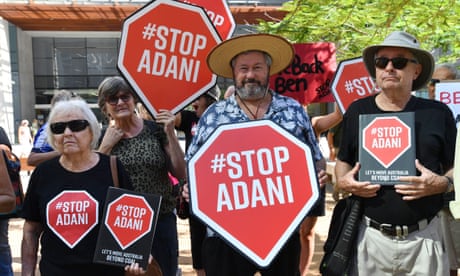

So far, just one project has made it through the starting gate – Adani’s controversial Carmichael mine, which sent its first coal to port late last year. The mine was supposed to be the first of many.

Yet there is little sign of more coal to come, with many projects shelved, lapsed or discontinued, and uncertain futures for those that remain.

“There was genuine hope, and house and land prices skyrocketed,” says Sean Dillon, the mayor of Barcaldine regional council, which covers several small towns including Alpha, Barcaldine, Aramac and Jericho in the basin.

Dillon says communities have become jaded by the promises of jobs and income.

“Everything was on the cusp and then it just got mothballed. It’s left a few communities scratching their heads,” he says.

Dillon’s own cattle station property north of Alpha sits over one of the proposed mines, known as Kevin’s Corner. That tenement, along with two others, was sold in 2011 by Gina Rinehart’s Hancock Prospecting for a reported $1.2bn to the Indian conglomerate GVK.

Dillon says his understanding is that project is now “completely dormant”.

The broader failure of many of the mines to materialise is down to “geography and workforce”. All the mines are greenfield sites – largely undeveloped land still covered in scrub or fields – with high costs to develop the infrastructure needed.

He says most people in the region are not opposed to new coalmines, but there’s a desire for diversification of an economy that’s dominated by agriculture.

A state government-backed plan for a renewable energy precinct in the region has “got people excited”, he says.

“These non-traditional jobs … people are not against them, but they are just more familiar with resource extraction jobs. But they are keen to see some alternative options.”

Approved but not progressed

The one project that has got off the ground, Adani’s Carmichael mine, still retains approvals to mine up to 60m tonnes of coal a year for export to power stations. But the company has said the project is currently downscaled to a 10m-tonne-a-year operation.

In the early 2010s, the Queensland government passed environmental approvals for six mines in the Galilee – including Carmichael – with more than 15,000 operational jobs claimed across the projects.

By 2014, a government-backed assessment of the basin’s coal identified four mines that had gained initial approval, two more going through environmental approvals and a further seven considered at much earlier stages of development.

Earlier reports from environment groups and others identified nine of those projects as “megamines” which, if they gained approvals and were at full production, would produce 330m tonnes of coal a year.

When burned, all that coal would emit 857m tonnes of CO2 a year, according to a report from Climate Analytics.

But slowly the projects – and the jobs claims – have fallen away.

The Degulla mine had an estimated 35m tonnes of coal a year waiting to be dug. But in 2013 its Brazil-based owner Vale, one of the world’s biggest miners, put the project on the market.

Vale announced last year it was getting out of coal altogether and told the Guardian this week it still has “exploration tenements in the [Galilee] region that are in [the] process of divestment”.

The Chinese-owned Macmines Austasia abandoned its bid for a mining lease for its $6.7bn China Stone mine in 2019.

A state environmental assessment for another mine, the South Galilee Coal project, lapsed in late 2019. The project’s part-owner had already gone into administration and there’s little sign of action from the mine’s American investor.

Hancock Prospecting has interests in two mines and Clive Palmer’s Waratah Coal also has two mine projects identified.

Market analysts S&P Global said in a bulletin in December there was “yet to be any commitment registered for these projects”.

Palmer’s Galilee Coal project – once known as the China First mine – is linked to his company’s plans to build a power station in the Barcaldine region. Those plans, submitted to the Barcaldine regional council, were called in by the state government in December.

Tim Buckley, an energy market analyst at the pro-renewables Institute for Energy Economics and Financial Analysis, says when the Galilee projects were proposed, they threatened to become “a climate bomb that was unparalleled”.

“All but one didn’t even get out of the starting blocks and I think none will,” he says.

Buckley says the entire economic rationale for coal has changed since the projects were announced.

“A decade ago it was about catering for a growth in demand in energy across Asia,” he says. “But now it is about decarbonisation. It is accepted now that coal is on a slow but terminal decline. The world is completely different now.”

A December report from the Office of the Chief Economist noted 37 coal projects in Australia at the feasibility stage, but many were delayed.

There was a growing preference for expansions of brownfield sites – previously utilised land – over greenfield investments, the report said, with “an expanding list of lenders/investors who have withdrawn from financing new thermal coal projects”.

The Queensland government is working on a development plan for the resources industry. A draft says that the global market for thermal coal “is likely to decline as countries choose their own path to reduced emissions” but there could still be pockets of growth.

“Queensland’s high-quality thermal coal deposits mean that we are well placed to respond to these opportunities, while continuing to support the coal industry to decarbonise and remain competitive for longer,” the draft says.

In a statement, the Queensland resources minister, Scott Stewart, said the “development of any specific project is a matter for the relevant company”.

He said the government had “long held the position that we support resources projects which stack up financially, environmentally and socially”.

Stewart said the plan would look at “taking advantage of the worldwide demand for new economy minerals which are critical as part of clean energy technology like batteries and renewables”.

No comments:

Post a Comment