Extract from The Guardian

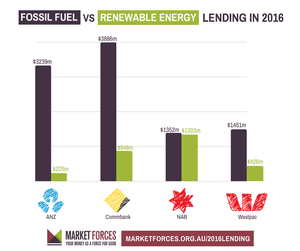

ANZ, NAB, Commonwealth Bank and Westpac provided three times more

for non-renewable than clean energy projects in 2016, says Market

ForcesAustralian banks continued to fund coalmines in 2016 despite committing to support the Paris climate agreement pledge to keep global warming below 2C. Photograph: Viktor Drachev/Tass

Naaman Zhou

Monday 6 March 2017 06.13 AEDT

Australia’s big four banks invested three times as much in global fossil fuels than clean energy in 2016, despite pledging to help Australia transition to a low carbon economy.

The banks provided a combined $10bn to projects around the world that expanded non-renewable energy, according to finance group Market Forces.

ANZ and the Commonwealth Bank were the worst offenders, investing over $3bn each in fossil fuels. In the same period, ANZ only lent $225m to renewables, giving it a 14:1 ratio.

Overall the banks invested $7bn more in fossil fuels than clean energy.

Only NAB approached parity, lending $1.35bn to non-renewables and $1.3bn to renewables. Commonwealth Bank and Westpac invested $846m and $426m in clean energy respectively, which was 3.5 and 4.6 times less than what they invested in fossil fuels.

Loans for renewable and fossil fuel

energy projects from Australia’s big four banks in 2016.

Illustration: Market Forces

“The first step to back up that commitment is to stop expanding the carbon fuel economy,” said the executive director of Market Forces, Julien Vincent. “We’re not talking small projects, we’re talking about opening up one of the largest offshore oil bases in Norway, or a new gas field in PNG.”

The report cited, among others, investments in Norway’s Johan Sverdup oil field, America’s Creole Trail natural gas pipeline, and the Browse basin gas field off the coast of Western Australia.

The Commonwealth Bank environment policy states it should “actively seek opportunities to lend to, invest in, and support businesses that decrease dependence on fossil fuels”.

“The updated policy expresses our commitment to support the transition to a low carbon economy”, it said in a 2015 press release.

ANZ’s climate change statement notes that while “some of our stakeholders view our financing of fossil fuel industries as in direct conflict with our stated position on the need to reduce greenhouse gas emissions”, it supports a “gradual and orderly transition”.

Vincent said the figures included loans made to coal and gas projects “across the entire supply chain – from extraction to transport and combustion”. For companies with part-investments in fossil fuels, Market Forces apportioned the loan according to the percentage of the company’s business in non-renewables.

However, he noted that 2016 saw less fossil fuel investment than 2015, and no loans to new coal projects, in what he described as an “important trend”.

“I think it’s definitely become a lot harder for banks to fund coal because it’s so clearly connected to climate change and other environmental and social issues,” he said. He called for Australian banks to put a blanket bans on funding new coalmines.

“I wouldn’t ever take the kind of positive trends we see in the lending and assume the banks aren’t going to fund the Adani coalmine, for example. Politically there is a lot of leaning on the banks to not cave in to environmental campaigns. We need them to show a little bit of courage and say no to the Carmichael coalmine and expansion.”

An ANZ spokesperson said that “lending to the sector was relatively modest.”

“The resources industry is a core part of the Australian economy. It remains essential for power generation … we consider that decarbonisation of the economy must be managed responsibly and over time,” it said.

No comments:

Post a Comment