Extract from The Guardian

In the UK, which has been building reactors intermittently, costs for the under construction Hinkley C reactor, pictured, started at $34bn and could be as high as $89bn.

The agency’s GenCost analysis says a first nuclear plant for Australia would deliver power ‘no sooner than 2040’ and could cost more than $16bn.

Sun 26 May 2024 06.00 AEST

Last modified on Sun 26 May 2024 06.30 AESTThe Coalition’s pitch on nuclear energy for Australia has had two recurring themes: the electricity will be cheap and it could be deployed within a decade.

CSIRO’s latest GenCost report – a document that analyses the costs of a range of electricity generation technologies – contradicts both of these points. It makes the Coalition’s job of selling nuclear power plants to Australians ever more challenging.

For the first time, the national science agency has calculated the potential costs of large-scale nuclear electricity in a country that banned the generation technology more than a quarter of a century ago.

Even using a set of generous assumptions, the CSIRO says a first nuclear plant would deliver power “no sooner than 2040” and could cost more than $17bn.

It is likely to spark an attack on the credibility of the report from nuclear advocates and those opposed to the rollout of renewable energy. Opposition leader, Peter Dutton, has already attacked the report.

In the meantime, Australia waits for the Coalition to say what kind of reactors it would deploy, where it would put them and how much it thinks they would cost.

Now that CSIRO has released its report, here’s what we know about the viability of a nuclear industry in Australia.

What’s new on nuclear costs?

CSIRO’s GenCost report says a 1,000 megawatt nuclear plant would cost about $8.6bn to build, but that comes with some large caveats. The main one is that this was the theoretical cost of a reactor in an Australia that already had an established and continuous program of building reactors.

The $8.6bn is based on costs in South Korea, which does have a continuous reactor building program and is one country the least beset by cost blowouts.

To make the cost more relevant, CSIRO compared the Australian and South Korean costs of building modern coal plants. Costs were more than double in Australia.

But CSIRO warns the first nuclear plants in Australia would be subject to a “first of a kind” premium that could easily double the $8.6bn build cost.

In the UK, a country that has been building reactors intermittently, costs for its under-construction Hinkley C reactor (more than three times the size of a theoretical 1,000MW reactor in Australia) started at $34bn and could now be as high as $89bn.

In the United States, the country’s largest nuclear plant has just turned on its final unit seven years behind schedule and at double the initial cost. There are no more nuclear plants under construction in the country.

What about the cost of the electricity?

CSIRO also offers cost estimates for the electricity produced by large-scale reactors, but those too assume a continuous nuclear building program in Australia.

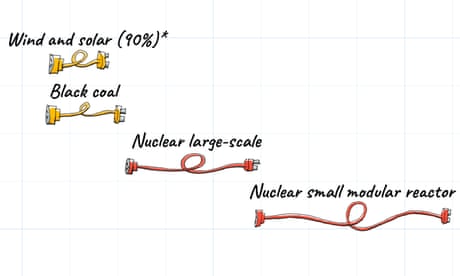

Electricity from large-scale reactors would cost between $141 per megawatt hour and $233/MWh if they were running in 2030, according to GenCost.

Combining solar and wind would provide power at between $73 and $128/MWh – figures that include the costs of integrating renewables, such as building transmission lines and energy storage.

What about those small modular reactors?

The Coalition has also advocated for so-called “small modular reactors” which are not commercially available and, CSIRO says, are unlikely to be available to build in Australia until 2040.

One United States SMR project lauded by the Coalition collapsed in late 2023 because the cost of the power was too high.

That project, CSIRO says, was significant because its design had nuclear commission approval and was “the only recent estimate from a real project that was preparing to raise finance for the construction stage. As such, its costs are considered more reliable than theoretical projects.”

GenCost reports that power from a theoretical SMR in 2030 would cost between $230 and $382/MWh – much higher than solar and wind or large-scale nuclear.

How quickly could Australia build a nuclear plant?

Nuclear advocates tend to point to low nuclear power costs in countries that have long-established nuclear industries.

Australia has no expertise in building nuclear power, no infrastructure, no regulatory agency, no nuclear workforce and a public that is yet to have a serious proposition put in front of it.

Australia’s electricity grid is fast evolving from one dominated by large coal-fired power plants to one engineered for and dominated by solar, wind, batteries and pumped hydro with gas-fired power working as a rarely used backup.

This creates a major problem for the Coalition, because CSIRO estimates “if a decision to pursue nuclear in Australia were made in 2025, with political support for the required legislative changes, then the first full operation would be no sooner than 2040.”

Tony Wood, head of the Grattan Institute’s energy program, says: “By 2040, the coal-fired power stations will be in their graves. What do you do in the meantime?”

“You could keep the coal running, but that would become very expensive,” he says, pointing to the ageing coal fleet that is increasingly beset by outages.

Wood says the GenCost report is only a part of the story when it comes to understanding nuclear.

The Coalition, he says, would need to explain how much it would cost to build an electricity system to accommodate nuclear.

Could you just drop nuclear into the grid?

The biggest piece of generation kit on Australia’s electricity grid is a single 750 megawatt coal-fired unit at Kogan Creek in Queensland. Other power stations are larger but they are made up of a series of smaller units.

But the smallest of the “large-scale” nuclear reactors are about 1,000MW and most are 1,400MW.

Electricity system engineers have to build-in contingency plans if large units either trip or have to be pulled offline for maintenance. That contingency costs money.

In Australia’s current electricity system, the GenCost report says larger nuclear plants would probably “require the deployment of more generation units in reserve than the existing system consisting of units of 750MW or less.”

But by the time a theoretical nuclear plant could be deployed, most if not all the larger coal-fired units will be gone.

Who might build Australian nukes?

Some energy experts have questioned whether any company would be willing to take up a contract to build a reactor in Australia when there are existing nuclear nations looking to expand their fleets.

Right now, nuclear reactors are banned federally and in several states.

The GenCost report also points to another potential cost-raiser for nuclear – a lack of political bipartisanship.

The report says: “Without bipartisan support, given the historical context of nuclear power in Australia, investors may have to consider the risk that development expenses become stranded by future governments.”

No comments:

Post a Comment