Researchers say those forced onto controversial income management have ‘overwhelming number’ of negative experiences

The government’s controversial cashless debit card scheme and other compulsory welfare income management programs are causing more harm than good, a new study has found.

Researchers from four universities said in a new report released on Wednesday that they had “uncovered an overwhelming number of negative experiences” stemming from the card, ranging from feelings of “stigma, shame and frustration” to practical issues such as cardholders simply not having enough cash for essential items.

“Our research illustrates that the empirical case for continuing with the current policy settings on [compulsory income management] is weak,” the study said. “Our research is certainly not the first to suggest these set of policy measures require a fundamental rethink.”

The report, described by the researchers as the first large, independent study of compulsory income management in Australia, comes as the government seeks the Senate’s support for an expansion of the card into the Northern Territory, where welfare recipients are currently placed on the similar Basics Card.Researchers from four universities said in a new report released on Wednesday that they had “uncovered an overwhelming number of negative experiences” stemming from the card, ranging from feelings of “stigma, shame and frustration” to practical issues such as cardholders simply not having enough cash for essential items.

“Our research illustrates that the empirical case for continuing with the current policy settings on [compulsory income management] is weak,” the study said. “Our research is certainly not the first to suggest these set of policy measures require a fundamental rethink.”

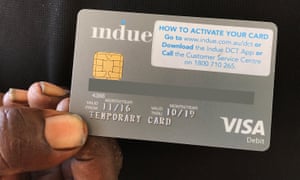

In an effort to reduce social harm, both programs quarantine a proportion of a person’s welfare payments – usually 80% – onto a debit card that cannot be used to purchase alcohol or gambling products or withdraw cash.

Researcher Prof Greg Marston, of the University of Queensland, told Guardian Australia that while some people who had volunteered to take part in income management said they had benefited from the policy, most compulsory participants found it “harmful”.

“The majority of people didn’t have a problem with spending or budgeting, what they had a problem with was inadequate income support payments,” Marston said. “In fact, most of the people we spoke with were very good at budgeting, they just didn’t have enough money to cover all their expenses.”

The study was prepared by researchers from the universities of Queensland, Griffith and Monash, based on 114 in-depth interviews with participants in the cashless debit card trial sites of Ceduna (South Australia) and Hinkler (Queensland), as well as Playford (SA) and Shepparton (Victoria), where the Basics card is in place. The cashless debit card is also in place in the East Kimberley and Goldfields areas of Western Australia.

In the study’s survey, 76% of participants said they did not have enough cash to support their needs, while respondents also complained about struggling to provide for their children and paying rent and other bills.

“School excursions are cash only,” said one respondent. “The fair and Christmas parade activities are predominantly cash only. I have four children and 20% doesn’t get us far.”

While 84% of survey respondents had experienced stigma and shame while using the card, Marston said this became clearer during the in-depth interviews conducted with recipients.

“When you started talking to people, they would be visibly upset, recalling incidents where they’ve been called out for being on the cards and the way in which they hide the cards when they’re making transactions in shops,” he said.

In Hinkler, the largest trial site, the researchers said participants complained about their cards being declined at certain businesses and payment transfer problems that meant their bills sometimes went unpaid. Others said they had encountered fees, despite the card being “fee free”, or noted that some retailers charged a surcharge for Eftpos payments.

But the report also notes that there was a “minority of positive accounts about how [income management] had sharpened thinking around budgeting”. These included recipients who had admitted issues with overspending on items like alcohol.

Marston said generally those who welcomed the “discipline” of the card had volunteered to use it.

“We don’t discount the place for a voluntary income management scheme and think that one of the reforms the government could make is to continue with a voluntary scheme,” he said. “But we really don’t see the value in continuing with a compulsory scheme.”

The government has been working with the big banks and retailers to improve the technical aspects of the card, which it claims could further reduce stigma, while singing the card’s praises as a “financial literacy tool”.

Anne Ruston, the social services minister, said earlier this month that there had been many “positive stories that are coming out of these communities” where the card was in place.

“One of the big criticisms was the stigmatisation of the card and I think that we’re addressing that,” she said. “One of the other things was the universal functionality of the card and I think technology is allowing us to deal with that.”

The government is expected to release its own study of the scheme conducted by the University of Adelaide later this year.

No comments:

Post a Comment