Extract from The Conversation (August 29, 2014)

Robert Menzies left Australia in far worse financial shape than he found it, at least according to current treasurer Joe Hockey’s favourite debt and deficit benchmark. Having inherited budget surpluses from the Chifley Labor government, the Menzies Coalition government ran small budget surpluses from 1949-50 to 1957-58.

But then Menzies’ “irresponsible profligacy” began, running budget deficits for the last nine years of his reign.

Between 1958-59 and 1966-67, Menzies averaged budget deficits of 1.8% of GDP. His biggest deficit of 3.3% of GDP in his final year in office was larger than the last Swan deficit, which the Abbott government has called a “disaster” and a “budget crisis”.

While Hockey borrowed his “lifters and leaners” line from Menzies, he has not borrowed his fiscal strategy. Spending as a percentage of GDP rose steadily and substantially under Menzies, from 19.4% of GDP to 24.5%. The public sector that Hockey so derides grew by around 25% while Menzies, a Liberal hero to prime ministers John Howard and Tony Abbott – as well as Hockey – was calling the shots.

Read news from Australia’s most trusted political reporter, Michelle Grattan.

Tax grew steadily under Menzies as well. The tax-GDP ratio rose from 19.6% of GDP to 21.2% over his time at the helm. Because tax didn’t rise as fast as government spending, the Commonwealth deficit grew steadily.

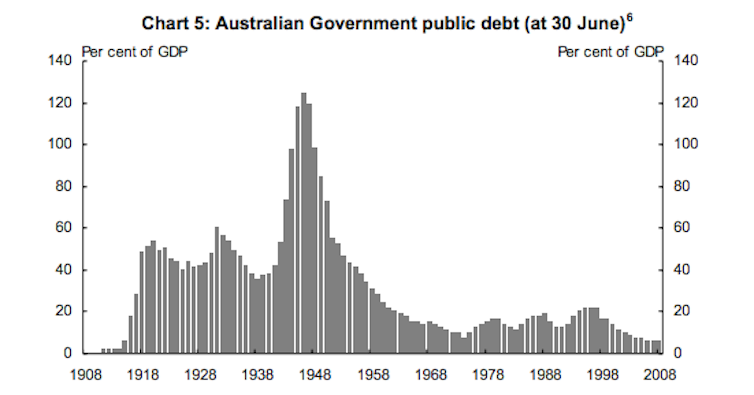

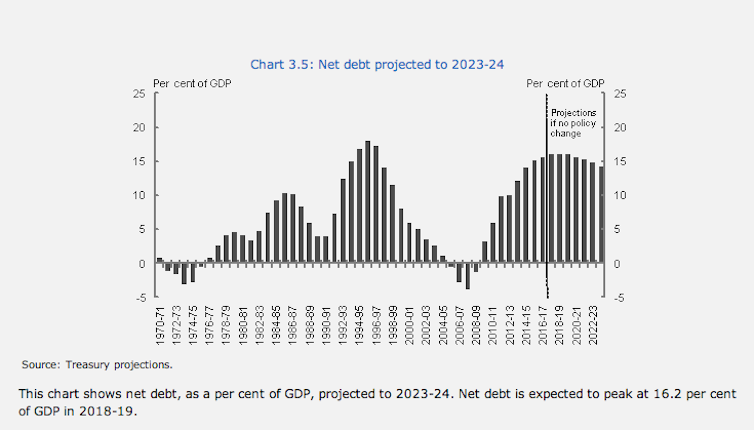

As budget deficits are typically funded by government borrowing, they

usually result in an increase in public debt. Menzies had been paying

off wartime debt early in his term, but debt increased to be at 41% of GDP when Menzies retired.

To put that into perspective, Commonwealth net debt stood at 12.5% of GDP at June, up from 10.1% in June 2013.

Menzies focused on the economy

So, what was Menzies up to? He clearly wasn’t obsessed with the budget deficits or worried about numbers of public servants that so concern Hockey. The economy grew quite steadily, often growing at more than 6% in real terms. Unemployment was mostly around 2% or less, and only 1.6% when he retired. Over his time in power, you couldn’t even argue that Menzies was trying to balance the budget over the business cycle.

Menzies was interested in nation-building. He not only wanted rapid population growth, but he wanted infrastructure growth and growth in the health and education services that make a society both cohesive and productive.

Like any successful corporate leader, he was willing to use long-run debt financing to fund long-run investments. Menzies knew that a lot of his budget spending was for capital projects that would deliver benefits for decades, so why should he have funded them entirely out of one year’s revenue?

Hockey, on the other hand, wants to fund a big increase in infrastructure spending with no increase in tax and no increase in debt. He wants to fund more capital spending by cutting spending on essential services and income support for poor people.

The simplistic notion that a deficit is evidence that a government is “living beyond its means” is complete economic nonsense. Leaving aside that historic and international evidence provides no support for the claim that budget deficits cause long-run economic problems, the argument is contradicted by the corporate decision making that politicians pretend to emulate.

During the mining boom, BHP ran large and repeated “budget deficits”. The company’s annual reports provide clear evidence that BHP spent far more than it earned. But rather than criticise BHP for its “irresponsible” borrowing, shareholders reaped billions in dividends and watched their share price grow. How could this be?

Contrary to virtually every word spoken by our political leaders, there is absolutely no relationship between a budget surplus and a profit. They aren’t just different concepts, they are unrelated concepts. They have nothing in common except that people generally think both of them sound good.

Budgets require long-term vision

The reason that BHP ran very large deficits during the mining boom is that, like Menzies, the company was spending large amounts of money on long-lived assets that would deliver benefits for decades to come. First-year economics and accounting students could tell you that you don’t treat purchasing an asset as an “expense” in the year in which the cheques are written.

What corporations do, and what governments used to do, is to distinguish between capital spending (spending that delivers future benefits) and recurrent spending (spending that delivers transient benefits). Only the portion of capital spending that is “used up” in the current year is included as an expense, and this portion is called “depreciation”.

So when BHP spends A$3 billion building a mine that is expected to last 30 years, the company might record a “depreciation expense” of $100 million.

The same is true for households. While political leaders like Hockey often tell us that governments are like households and shouldn’t “live beyond their means”, in reality most households aspire to rack up huge “budget deficits”. If you earned $60,000 a year and borrowed $500,000 to buy a house, then, assuming you didn’t spend a cent on anything else that year, you would have incurred a “budget deficit” of $440,000.

The reason that companies and households rack up huge debt is because they think the things they are investing in will deliver long-run benefits that far exceed the combination of the upfront costs and interest paid on the debt. Investment markets rarely complain about the “interest burden” carried by such companies. Rather, they often accuse them of having a “lazy balance sheet”, which means they haven’t borrowed enough to invest in growth.

This year, the Australian population will grow by around 400,000 people. Since Sydney hosted the Olympics in 2000, Australia’s population has grown by 22% from 19.3 million to 23.6 million. That is why Australia’s roads, trains and hospitals are crowded.

If the government wants to double Australia’s population by 2060, it can either invest in the new infrastructure the country needs before the population arrives, or it can lower Australians’ expectations about how much infrastructure we should expect. It seems clear we are being warmed up for the latter.

If Australians demand more infrastructure, Hockey tells us that the price of funding new roads and hospitals reduces spending on trains and nurses. This is not the logic of Menzies, nor is it the logic of BHP. It is, however, the logic of a treasurer and a government that wants to use vague notions of “economic responsibility” to drive big reductions in the social safety net.