The South Australian battery pockets $4m as the market looks to unlock multiple potential value streams

The Tesla big battery at Hornsdale in South Australia

continues to make its mark on the Australian energy market, pocketing

another $4m in the fourth quarter from the provision of frequency and

ancillary services.

The number was revealed in the Australian Energy Market Operator’s latest Quarterly Dynamics report, which also reveals a growing focus on energy storage, and time shifting and energy arbitrage in particular.The fourth quarter was notable because it saw the number of big batteries on the main grid multiply, with the addition of the Dalrymple North battery in South Australia, and the Gannawarra and Ballarat big batteries in Victoria.

It also saw a record amount of pumped hydro used since 2008, a sure sign of the greater role for energy storage that is to come as the share of wind and solar continues to soar and more battery and pumped hydro systems, along with other forms of storage such as hydrogen and solar thermal, come into the system.

"The market is waiting for new rules to unlock the multiple potential value streams for battery storage"

The performance and business model of the Tesla big battery has been a source of fascination for the industry since its opening more than 14 months ago. Tesla founder and CEO Elon Musk recently confirmed that the $95m facility was likely to pay itself back within a few years.

The battery, actually owned and operated by Neoen Australia, receives a $4m a year payment for providing grid services to the South Australia government – a payment worth significantly more given its recent performance keeping the lights on in the state after a lightning strike in northern NSW led to load shedding and generator trips in all other states.

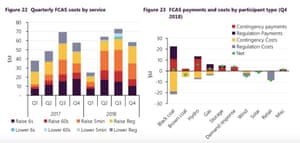

Tesla has also made money out of the FCAS (Frequency Control Ancillary Services) market, and lowered costs at the same time. Its presence has effectively destroyed a “cartel”- like play that pushed prices into the stratosphere, and allowed Aemo to remove constraints that were exploited by the gas generators.

But it also reveals growing opportunities in energy storage and time shifting, likely to be the key metric for most of the batteries that follow, given the opportunities within the FCAS market are limited.

Aemo noted that there are now significantly higher spreads between peak and off-peak prices in the wholesale market, and the difference had nearly doubled to $47/MWh from $25/MWh in Queensland and NSW over the last year.

But here’s the problem. The “round trip efficiency” means that the “park spreads”, the profits made by the various storage facilities, are still low for energy arbitrage.

In fact, for pumped hydro, the “park spread” was zero, meaning that after losses from the pumping process, it made no money. Batteries (mostly Hornsdale but in the latter weeks of the quarter also the other facilities) made a “park spread” of $20/MWh – but that was mostly courtesy of their participation in the FCAS markets.

Still, the graph above shows that batteries such as Hornsdale appeared to make more out of energy arbitrage – perhaps due to their speed of response – than the pumped hydro facilities. And, of course, most of their money came from contingency and regulation FCAS.

It goes to highlight that until new rules are introduced and come into effect that can recognise and unlock the multiple potential value streams for battery storage, the facilities may struggle to find a suitable business model.

That will be of keen interest to the promoters and builders of new batteries, such as those going in at the Lake Bonney and Lincoln Gap windfarms in South Australia, proposed by Sanjeev Gupta for Whyalla, and AGL in Queensland, and numerous other projects promising big things in storage.

• Giles Parkinson is the editor of RenewEconomy, where this article was originally published

No comments:

Post a Comment